UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to SectionPROXY STATEMENT PURSUANT TO SECTION 14(a) of the SecuritiesExchange Act ofOF THE SECURITIES EXCHANGE ACT OF 1934 (Amendment

(Amendment No. )

| Filed by the Registrant |   | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material |

PROVIDENT FINANCIAL SERVICES, INC.

(Name of Registrant as Specified Inin Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check | ||

| No fee required. | |

| ||

| Fee paid previously with preliminary materials. | |

| ||

| ||

| 239 Washington Street Jersey City, New Jersey | ||

Dear Fellow Stockholder:

I am pleased to invite you to attendparticipate in the 20202022 Annual Meeting of Stockholders of Provident Financial Services, Inc., which will be held virtually on Thursday, April 23, 2020,28, 2022, at 10:00 a.m., local time, attime. The virtual meeting platform provides for the Delta Hotels Marriott, 515 U.S. Highway 1 South, Iselin, New Jersey.safe execution of the Annual Meeting in the continuing COVID-19 environment. Information on how you can participate in the virtual Annual Meeting can be found on page 65 of the proxy statement.

At our Annual Meeting you will be asked to elect fivefour directors, approve on an advisory (non-binding) basis the compensation paid to our named executive officers, and ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2020.2022.

Your vote is very important regardless of the number of shares you own. Whether or not you plan to attendparticipate in the Annual Meeting, I encourage you to promptly submit your vote by Internet, telephone or mail, as applicable, to ensure that your shares are represented at our Annual Meeting.

On behalf of the board of directors, officers and employees of Provident Financial Services, Inc., we thank you for your continued support and look forward to seeing you at our Annual Meeting.support.

Sincerely,

Christopher Martin

Chairman, President and Chief Executive OfficerChairman

March 13, 202018, 2022

| Table |

| of Contents | ||

| |

Annual Meeting

of Stockholders

Virtual Meeting Information

THURSDAY, APRIL 23, 202028, 2022

10:00 a.m., Local Time

Delta Hotels Marriott

515 U.S. Highway 1 South, Iselin, New Jerseywww.virtualshareholdermeeting.com/PFS2022

NOTICE IS HEREBY GIVEN THAT the 20202022 Annual Meeting of Stockholders of Provident Financial Services, Inc. will be held at the Delta Hotels Marriott, 515 U.S. Highway 1 South, Iselin, New Jersey,in a virtual format on Thursday, April 23, 2020,28, 2022, at 10:00 a.m., local time, to consider and vote upon the following matters:

| 1. | The election of four |

| 2. | An advisory (non-binding) vote to approve the compensation paid to our named executive officers. |

| 3. | The ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, |

| 4. | The transaction of such other business as may properly come before the Annual Meeting, and any adjournment or postponement of the Annual Meeting. |

The board of directors of Provident Financial Services, Inc. established March 2, 20201, 2022 as the record date for determining the stockholders who are entitled to notice of, and to vote at the Annual Meeting, and any adjournment or postponement of the Annual Meeting.

You may participate in the virtual Annual Meeting via the internet at www.virtualshareholdermeeting.com/ PFS2022 by using the 16-digit control number included on your proxy card, voting instruction form or notice received by you.

Your vote is very important. Please submit your proxy as soon as possible via the Internet, telephone or mail, as applicable.Stockholders of record who attendparticipate in the Annual Meeting may vote in person,electronically, even if they have previously mailed or delivered a signed proxy or voted by Internet or telephone.

By Order of the Board of Directors

John Kuntz, Esq.

Corporate Secretary

Jersey City, New JerseyMarch 13, 2020

Review your proxy statement and vote in one of four ways: | |||

|   |   |   |

INTERNET | BY TELEPHONE | BY MAIL | DURING THE ANNUAL MEETING |

| Visit the website on your proxy card |

Call the telephone number

|

Sign, date and return card in the |

|

| Please refer to the enclosed proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you. | |||

| PROVIDENT FINANCIAL SERVICES, INC. | | | |||

InternetAvailability of Proxy Materials

We are relying upon a U.S. Securities and Exchange Commission rule that allows us to furnish proxy materials to stockholders overvia the Internet. As a result, beginning on or about March 13, 2020,18, 2022, we sent by mail or e-mail a Notice Regarding the Availability of Proxy Materials containing instructions on how to access our proxy materials, including our Proxy Statement and Annual Report to Stockholders, overvia the Internet and how to vote. Internet availability of our proxy materials is designed to expedite receipt by stockholders and lower the cost and environmental impact of our Annual Meeting. However, if you received such a notice and would prefer to receive paper copies of our proxy materials, please follow the instructions included in the Notice Regarding the Availability of Proxy Materials.

If you received your proxy materials via e-mail, the e-mail contains voting instructions, including a control number required to vote your shares, and links to the Proxy Statement and the Annual Report to Stockholders on the Internet. If you received your proxy materials by mail, the Notice of Annual Meeting, Proxy Statement, Proxy Card and Annual Report to Stockholders are enclosed.

If you hold our common stock through more than one account, you may receive multiple copies of these proxy materials and will have to follow the instructions for each in order to vote all of your shares of our common stock.

Important Notice Regarding the Availability of Proxy Materials

for the 20202022 Annual Meeting of Stockholders to be Held in a Virtual Format on April 23, 2020:28, 2022

Our Proxy Statement and 20192021 Annual Report to Stockholders are available

at www.proxyvote.com

| www.provident.bank | PROVIDENT FINANCIAL SERVICES, INC. | | | ||

GeneralProposal 1Information Election of Directors

The board of directors of Provident Financial Services, Inc. (“Provident” or “company”) is soliciting proxies for our 2020 Annual Meeting of Stockholders, and any adjournment or postponement of the meeting (“Annual Meeting”). The Annual Meeting will be held on Thursday, April 23, 2020 at 10:00 a.m., local time, at the Delta Hotels Marriott, 515 U.S. Highway 1 South, Iselin, New Jersey.

A Notice Regarding the Availability of Proxy Materials is first being sent to our stockholders on March 13, 2020.

The 2020 Annual Meeting of Stockholders

Date, Time and Place: Our Annual Meeting of Stockholders will be held on April 23, 2020, 10:00 a.m., local time, at the Delta Hotels Marriott, 515 U.S. Highway 1 South, Iselin, New Jersey

Record Date:March 2, 2020.

Shares Entitled to Vote: 65,826,269 shares of Provident common stock were outstanding on the record date and are entitled to vote at the Annual Meeting.

Purpose of the Annual Meeting: To consider and vote on the election of five directors, an advisory (non-binding) vote to approve the compensation paid to our named executive officers, and the ratification of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2020.

Vote Required: Subject to our majority voting policy described under the heading “Corporate Governance Matters” in this Proxy Statement, directors are elected by a plurality of votes cast, without regard to either broker non-votes or proxies as to which authority to vote for the nominees proposed is withheld. The advisory vote to approve executive compensation and the ratification of KPMG LLP as our independent registered public accounting firm are each determined by a majority of the votes cast, without regard to broker non-votes or proxies marked “ABSTAIN”.

Board Recommendation: Our board of directors recommends that stockholders vote “FOR” each of the nominees for director listed in this Proxy Statement, “FOR” approval of the compensation paid to our named executive officers, and “FOR” the ratification of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2020.

Provident: Provident is a Delaware corporation and the bank holding company for Provident Bank, an FDIC-insured New Jersey-chartered capital stock savings bank that operates a network of full-service branch offices throughout northern and central New Jersey and eastern Pennsylvania. Our principal executive offices are located at 239 Washington Street, Jersey City, New Jersey 07302. Our telephone number is (732) 590-9200.

March 2, 2020 is the record date for determining the stockholders of record who are entitled to vote at the Annual Meeting. On March 2, 2020, 65,826,269 shares of Provident common stock, par value of $0.01 per share, were outstanding and held by approximately 4,523 holders of record. The presence, in person or by properly executed proxy, of the holders of a majority of the outstanding shares of our common stock is necessary to constitute a quorum at the Annual Meeting.

Each holder of shares of our common stock outstanding on March 2, 2020 will be entitled to one vote for each share held of record. However, our certificate of incorporation provides that stockholders of record who beneficially own in excess of 10% of the then outstanding shares of our common stock are not entitled to vote any of the shares held in excess of that 10% limit. A person or entity is deemed to beneficially own shares that are owned by an affiliate of, as well as by any person acting in concert with, such person or entity.

The purpose of the Annual Meeting is to elect five directors, vote on an advisory basis on executive compensation, and ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2020. We may adjourn or postpone the Annual Meeting for the purpose of allowing additional time to solicit proxies.

Our board of directors is not aware of any other matters that may be presented for consideration at the Annual Meeting. If other matters properly come before the Annual Meeting, we intend that shares represented by properly submitted proxies will be voted, or not voted, by the persons named as proxies in their best judgment.

You may vote your shares:

If you return an executed Proxy Card without marking your instructions, your executed Proxy Card will be voted “FOR” the election of the five nominees for director, “FOR” approval of the executive compensation paid to our named executive officers, and “FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2020.

Participants in Provident Benefit Plans

If you are a participant in our Employee Stock Ownership Plan or 401(k) Plan, or any other benefit plans sponsored by us through which you own shares of our common stock, you will have received a Notice Regarding the Availability of Proxy Materials by e-mail. Under the terms of these plans, the trustee or administrator votes all shares held by the plan, but each participant may direct the trustee or administrator how to vote the shares of our common stock allocated to his or her plan account. If you own shares through any of these plans and you do not vote by April 19, 2020, the respective plan trustees or administrators will vote your shares in accordance with the terms of the respective plans.

The presence, in person or by properly executed proxy, of the holders of a majority of the outstanding shares of our common stock is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes (unvoted proxies submitted by a bank or broker) will be counted for the purpose of determining whether a quorum is present.

Subject to our majority voting policy described under the heading “Corporate Governance Matters” in this Proxy Statement, directors are elected by a plurality of votes cast, without regard to either broker non-votes or proxies as to which authority to vote for the nominees proposed is “Withheld.” The advisory vote on executive compensation, and the ratification of the appointment of our independent registered public accounting firm are each determined by a majority of the votes cast, without regard to broker non-votes or proxies marked “Abstain.”

You may revoke your proxy at any time before the vote is taken at the Annual Meeting. You may revoke your proxy by:

Written notices of revocation and other communications regarding the revocation of your proxy should be addressed to:

Provident Financial Services, Inc.100 Wood Avenue SouthP.O. Box 1001Iselin, New Jersey 08830-1001

If your shares are held in street name, you should follow your bank’s or broker’s instructions regarding the revocation of proxies.

Provident will bear the entire cost of soliciting proxies from you. In addition to solicitation of proxies by mail, we will request that banks, brokers and other holders of record send proxies and proxy materials to the beneficial owners of our common stock and secure their voting instructions, if necessary. We will reimburse such holders of record for their reasonable expenses in taking those actions. Equiniti (US) Services LLC will assist us in soliciting proxies, and we have agreed to pay them a fee of $5,000 plus reasonable expenses for their services. If necessary, we may also use several of our employees, who will not be specially compensated, to solicit proxies from stockholders, personally or by telephone, facsimile, e-mail or letter.

Unless you have provided us contrary instructions, we have sent a single copy of these proxy materials to any household at which one or more stockholders reside if we believe the stockholders are members of the same household. Each stockholder in the household will receive a separate Proxy Card. This process, known as “householding,” reduces the volume of duplicate information and helps reduce our expenses. If you would like to receive your own set of proxy materials, please follow these instructions:

Recommendation of the Board of Directors

Your board of directors recommends that you vote“FOR” each of the nominees for director listed in this Proxy Statement,“FOR” approval of the compensation paid to our named executive officers, and“FOR” the ratification of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2020.

Security Ownership of Certain Beneficial Owners and Management

Persons and groups who beneficially own in excess of five percent of Provident’s issued and outstanding shares of common stock are required to file certain reports with the Securities and Exchange Commission (“SEC”) regarding such beneficial ownership. The following table shows, as of March 2, 2020, certain information as to persons who beneficially owned more than five percent of the issued and outstanding shares of our common stock. We know of no persons, except as listed below, who beneficially owned more than five percent of the issued and outstanding shares of our common stock as of March 2, 2020.

Principal Stockholders

| Name and Address of Beneficial Owner | Number of Shares Owned and Nature of Beneficial Ownership | Percent of Shares of Common Stock Outstanding(1) | ||

| Provident Bank Employee Stock Ownership Plan Trust GreatBanc Trust Company, Trustee 801 Warrenville Road, Suite 500 Lisle, Illinois 60532 | 3,829,757 | (2) | 5.8% | |

| Dimensional Fund Advisors LP Building One 6300 Bee Cave Road Austin, Texas 78746 | 5,418,587 | (3) | 8.2% | |

| BlackRock, Inc. 55 East 52ndStreet New York, New York 10055 | 9,479,411 | (4) | 14.4% | |

| The Vanguard Group 100 Vanguard Boulevard Malvern, Pennsylvania 19355 | 6,460,354 | (5) | 9.8% |

Management

The following table shows certain information about shares of our common stock owned by each nominee for election as director, each incumbent director whose term of office continues following the Annual Meeting, each named executive officer identified in the summary compensation table included elsewhere in this Proxy Statement, and all nominees, incumbent directors and executive officers as a group, as of March 2, 2020.

| Name | Position(s) held with Provident Financial Services, Inc. and/or Provident Bank | Shares Owned Directly and Indirectly(1) | Shares Subject to Stock Options(2) | Beneficial Ownership | Percent of Class(3) | Unvested Stock Awards Included in Beneficial Ownership | ||||||

| Nominees | ||||||||||||

| Robert Adamo | Director | 12,744 | — | 12,744 | * | 3,432 | ||||||

| Laura L. Brooks | Director | 65,713 | — | 65,713 | * | 3,432 | ||||||

| Ursuline F. Foley | Director | 7,128 | 7,128 | * | 3,128 | |||||||

| Terence Gallagher | Director | 20,939 | — | 20,939 | * | 3,432 | ||||||

| Carlos Hernandez | Director | 80,691 | — | 80,691 | * | 3,432 | ||||||

| Incumbent Directors | ||||||||||||

| Thomas W. Berry | Director | 100,632 | — | 100,632 | * | 3,432 | ||||||

| James P. Dunigan | Director | 13,358 | — | 13,358 | * | 3,432 | ||||||

| Frank L. Fekete | Director | 64,485 | — | 64,485 | * | 3,432 | ||||||

| Matthew K. Harding | Director | 36,865 | — | 36,865 | * | 3,432 | ||||||

| Christopher Martin | Chairman, President and Chief Executive Officer | 570,501 | (4) | 447,037 | 1,017,538 | 1.5% | — | |||||

| John Pugliese | Director | 92,161 | — | 92,161 | * | 3,432 | ||||||

| Executive Officers Who Are Not Directors | ||||||||||||

| Donald W. Blum**(5) | Executive Vice President and Chief Lending Officer | 119,985 | — | 119,985 | * | 4,214 | ||||||

| John Kuntz | Senior Executive Vice President and Chief Administrative Officer | 120,921 | — | 120,921 | * | 4,898 | ||||||

| Thomas M. Lyons | Senior Executive Vice President and Chief Financial Officer | 190,363 | — | 190,363 | * | 20,335 | ||||||

| Valerie O. Murray** | Executive Vice President, Chief Wealth Management Officer and President of Beacon Trust Company | 33,637 | — | 33,637 | * | 4,002 | ||||||

| All directors and executive officers as a group (22 persons) | 1,799,784 | 447,037 | 2,246,821 | 3.4% | 90,535 | |||||||

| Name | 401(k) Plan Shares | ESOP Shares | |

| Christopher Martin | 157,986 | 16,757 | |

| Donald W. Blum(5) | 7,602 | 20,939 | |

| John Kuntz | 5,598 | 20,631 | |

| Thomas M. Lyons | 41,947 | 14,858 | |

| Valerie O. Murray | 11,332 | 4,904 | |

| All executive officers as a group (12 persons) | 227,223 | 121,341 |

Proposal 1Election of Directors

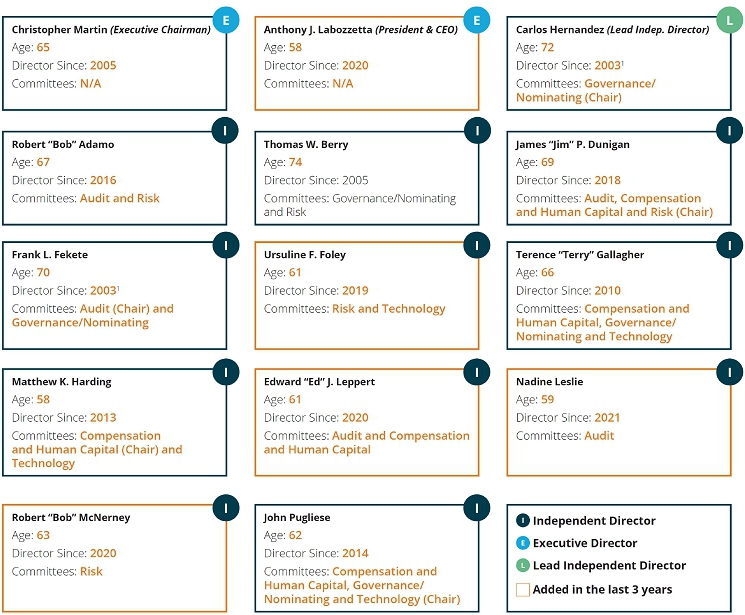

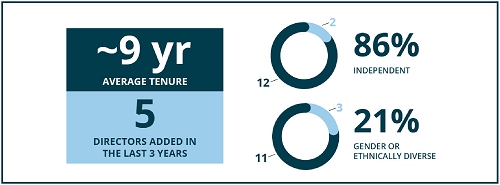

Our board of directors currently consists of elevenfourteen members and is divided into three classes, with one class of directors elected each year. Each member of our board of directors also serves as a director of Provident Bank. Directors are elected to serve for a three-year term and until their respective successors shall have been elected and qualified. A director is not eligible to be elected or appointed to either board of directors after reaching age 73.

Four directors will be elected at the Annual Meeting to serve for a three-year term and until their respective successors shall have been elected and qualified. On the recommendation of our Governance/Nominating Committee, our board of directors nominated Robert Adamo, LauraJames P. Dunigan, Frank L. Brooks, Terence GallagherFekete, Matthew K. Harding and Carlos HernandezAnthony J. Labozzetta for election as directors at the Annual Meeting. In addition, Ursuline F. Foley, who was first appointed to the boards of directors of Provident and Provident Bank in June 2019, is being nominated for election by the stockholders to the class of directors whose terms expire in 2021.

All of the nominees for election at the Annual Meeting currently serve as directors of Provident and Provident Bank, and other than Ms. Foley,Mr. Labozzetta, each of themnominee was previously elected by our stockholders. Ms. Foley was recommended for consideration by the non-management directors andMr. Labozzetta was appointed to the boards of directors of Provident and Provident Bank on June 20, 2019.following Provident’s acquisition of SB One Bancorp where he served as President and Chief Executive Officer and as a member of the board of directors. No arrangements or understandings exist between any nominee and any other person pursuant to which any such nominee was selected.Unless authority to vote for any or all of the nominees is withheld, it is intended that the shares represented by each fully executed Proxy Card will be voted “FOR” the election of all nominees.

Each of the nominees has consented to be named a nominee. In the event that any nominee is unable to serve as a director, the persons named as proxies will vote with respect to a substitute nominee designated by our current board of directors. At this time, we know of no reason why any of the nominees would be unable or would decline to serve, if elected.

| THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEES FOR DIRECTOR NAMED IN THIS PROXY STATEMENT. |

Our board of directors is comprised of individuals with considerable and varied business experiences, backgrounds, skills and qualifications. Collectively, they have a strong knowledge of our company’s business, strategy and markets and are committed to enhancing long-term stockholder value.

Our Governance/Nominating Committee is responsible for identifying and selecting director candidates who meet the evolving needs of our board of directors. Director candidates must have the highest personal and professional ethics and integrity. Additional criteria weighed by the Governance/Nominating Committee in the director identification and selection process include the relevance of a candidate’s experience to our business, enhancement of the diversity of experienceperspectives of our board, the candidate’s independence from conflict or direct economic relationship with our company, and the candidate’s ability and willingness to devote the proper time to prepare for, attend and participate in meetings. The Governance/Nominating Committee also takes into account whether a candidate satisfies the criteria for independence under our Independence Standards and the New York Stock Exchange listing standards, and if a nominee is sought for service on the Audit Committee, the financial and accounting expertise of a candidate, including whether the candidate qualifies as an Audit Committee financial expert.

While the Governance/Nominating Committee does not have a formal policy regarding diversity, on our board of directors, consideration is given to nominating persons withwhen assessing potential director nominees, gender, racial and ethnic diversity, as well as different perspectives and experience are considered to enhance the deliberation and strategic decision-making processes of our board of directors. Currently, 27%14% of our directors are women and 14% designate themselves as racially or minorities.ethnically diverse.

| PROVIDENT FINANCIAL SERVICES, INC. | | | ||

The following table states the name, the year service as a director commenced, and the term expiration date for each of our nominees for election as directors and each incumbent director whose term of office continues following the Annual Meeting.

| Name | Position(s) held with Provident Financial Services, Inc. and Provident Bank | Director Since(1) | Expiration of Term | ||||

| Nominees | |||||||

| Robert Adamo | Director | 2016 | 2020 | ||||

| Laura L. Brooks | Director | 2006 | 2020 | ||||

| Terence Gallagher | Director | 2010 | 2020 | ||||

| Carlos Hernandez | Director | 1996 | 2020 | ||||

| Ursuline F. Foley | Director | 2019 | 2021 | (2) | |||

| Incumbent Directors | |||||||

| Christopher Martin | Chairman, President and Chief Executive Officer | 2005 | 2021 | ||||

| John Pugliese | Director | 2014 | 2021 | ||||

| Thomas W. Berry | Director | 2005 | 2022 | ||||

| James P. Dunigan | Director | 2018 | 2022 | ||||

| Frank L. Fekete | Director | 1995 | 2022 | ||||

| Matthew K. Harding | Director | 2013 | 2022 |

The age and business experience of each of our nominees for election as directors, and theour incumbent directors, whose term of office continues following the Annual Meeting, and directorships held by them with other public companies during the past five years, as well as their qualifications, attributes and skills that led our board of directors to conclude that each such person should serve as a director are as follows:

Nominees:

Age 69 |

INDEPENDENT

Term Expires: 2022 Committees: • Audit • Compensation and Human Capital • Risk | Biography: Mr. Dunigan has over 30 years of financial services industry experience having served in executive leadership roles with PNC Asset Management Group, and as Interim Chief Investment Officer of the Pennsylvania State Treasury. Mr. Dunigan is a member of the board of directors of the Philadelphia Chapter of the National Association of Corporate Directors and a member of the board of trustees of the Legacy Foundation of the Union League of Philadelphia. His extensive experience in the financial services industry, and particularly in asset and wealth management, is a strategic asset to the board of directors. |

| FRANK L. FEKETE | ||

Age 70 | INDEPENDENT Director since: 2003(1) Term Expires: 2022 Committees: • Audit • Governance/ Nominating | Biography: Mr. Fekete is a certified public accountant and the Managing Partner of the accounting firm of Mandel, Fekete & Bloom, CPAs, located in Jersey City, New Jersey. He serves as chairman of the board of trustees of the Hackensack Meridian Health Network, chair of the board of trustees of St. Peter’s University, and as member of the board of trustees of John Cabot University in Rome, Italy. He has over 35 years of public accounting experience, including supervision of audits of public companies. His experience benefits our board of directors in its oversight of audit, financial reporting and disclosure issues, and Mr. Fekete qualifies as an Audit Committee financial expert. |

| (1) | Mr. Fekete has served on the board of directors of Provident Bank since 1995. |

| MATTHEW K. HARDING | ||

Age 58 | INDEPENDENT Director since: 2013 Term Expires: 2022 Committees: • Compensation and Human Capital • Technology | Biography: Mr. Harding is Chief Executive Officer and a member of the board of directors of Levin Management Corporation, a leading retail real estate services firm. Mr. Harding serves as Vice President of The Philip and Janice Levin Foundation and as Trustee of the Gill St. Bernard’s School. Mr. Harding’s experience provides our board of directors with a comprehensive understanding of the real estate markets from both a competitive and a credit risk perspective. |

| ANTHONY J. LABOZZETTA | ||

Age 58 | PRESIDENT & CEO Director since: 2020 Term Expires: 2022 | Biography: Mr. Labozzetta has been President and Chief Executive Officer of Provident and Provident Bank since January 2022. Prior to that time he served as President and Chief Operating Officer of Provident and Provident Bank since August 2020. He was previously President and Chief Executive Officer of SB One Bancorp and SB One Bank since January 2010. He was previously Executive Vice President of TD Bank from 2006 to 2010. Prior to his banking career, he was a certified public accountant with Deloitte LLP. Mr. Labozzetta’s over 30-year banking experience brings executive leadership experience and an extensive and diverse knowledge of the banking business to our board of directors. |

| www.provident.bank | PROVIDENT FINANCIAL SERVICES, INC. | 2022 Proxy Statement | 8 | ||

Incumbent Directors:

| ROBERT ADAMO | ||

Age 67 | INDEPENDENT Director since: 2016 Term Expires: 2023 Committees: • Audit • Risk |

Biography:

Mr. Adamo retired from the international public accounting and consulting firm of Deloitte LLP after a 40-year career where he served as a senior partner and as a member of the board of directors. |

| THOMAS W. BERRY | ||

Age 74 |

INDEPENDENT

Term Expires: 2022 Committees: • Governance/ • Risk |

Biography:

Mr. Berry retired from investment banking in 1998 after a 26-year career with Goldman Sachs & Co. where he served as a partner since 1986. Mr. Berry is a director of the Hyde and Watson Foundation. He has an extensive financial background and considerable experience in investment banking, as well as a strong knowledge of the capital and debt markets and mergers and acquisitions, which skills are valuable to our board of directors in its assessment of Provident’s sources and uses of capital. Mr. Berry will retire from the board of directors following the Annual Meeting. |

| URSULINE F. FOLEY | |||||

Age 61 |

INDEPENDENT

Term Expires: 2024 Committees: • Risk • Technology |

Biography:

|

|

|

|

|

|

|

| TERENCE GALLAGHER | ||||

Age 66 |

INDEPENDENT

Term Expires: 2023 Committees: • Compensation and Human Capital • Governance/ • Technology

|

Biography:

Mr. Gallagher is President of Battalia Winston, a national executive search firm headquartered in New York, New York. He has served on the Americas Board for the Association of Executive Search Consulting Firms and the Advisory Committee for the New Jersey Chapter of the National Association of Corporate |

| 9 | |||

| CARLOS HERNANDEZ | ||

Age 72 |

INDEPENDENT

|

|

• Governance/

|

Biography:

Mr. Hernandez is retired. He previously served as President of New Jersey City University, located in Jersey City, New Jersey. Mr. Hernandez currently serves as Lead Director and as Chair of the board of directors of The Provident Bank Foundation. As a |

| (1) | Mr. Hernandez has served on the board of directors of Provident Bank since 1996. |

| EDWARD J. LEPPERT | ||

Age 61 | INDEPENDENT Director since: 2020 Term Expires: 2023 Committees: • Audit • Compensation and Human Capital | Biography: Mr. Leppert is a certified public accountant and founder of Leppert Group LLC, and has been in public practice since 1986. He was formerly Chairman of the Board of both SB One Bancorp and SB One Bank. His experience with audit, financial reporting and disclosure and Environmental, Social and Governance, as well as his knowledge of |

| NADINE LESLIE | |||||

Age 59 | INDEPENDENT Director since: 2021 Term Expires: 2023 Committees: • Audit | Biography: Ms. Leslie currently serves as Chief Executive Officer of SUEZ North America, an American water service company. Ms. Leslie serves on the board of trustees of Hackensack Meridian Health Network, the board of directors of Montclair State University Foundation, and is a member of the board of directors of the National Association of Water Companies. Ms. Leslie adds executive experience and environmental expertise to the board of directors. | |||

| CHRISTOPHER MARTIN | ||

Age 65 | EXECUTIVE

Term Expires: 2024 |

Biography:

Mr. Martin has served as Executive Chairman since |

| PROVIDENT FINANCIAL SERVICES, INC. | 2022 Proxy Statement | 10 | |||

| ROBERT MCNERNEY | ||

Age 63 |

INDEPENDENT

Director since: 2020 Term Expires: 2024 Committees: • Risk | Biography: Mr. McNerney is the owner of a real estate company, McNerney & Associates, Inc. which provides appraisal, management, brokerage and development services throughout northern New Jersey and New York. He is a licensed appraiser and real estate broker in New Jersey and New York, and holds an MAI and SRA designation from the Appraisal Institute. He holds a CRE designation from the Counselors of Real Estate, which is awarded to individuals nominated by their peers who possess broad experience in the commercial real estate business. Mr. McNerney’s broad experience in the real estate markets and as a business owner provides the company valuable insight into current markets. |

| JOHN PUGLIESE | ||

Age | INDEPENDENT Director since: 2014 Term Expires: 2024 Committees: • Compensation and Human Capital • Governance/ • Technology

|

Biography:

Mr. Pugliese is retired. Until January 2021, he served as Chief Executive Officer of Motors Management Corporation which provides management oversight and direction to one of the top automobile dealership groups in the country. He formerly served as EVP and Head of Retail Banking for the Bank of New York Mellon. Mr. Pugliese serves as Chairman of the board of directors of Buzz Points (formerly Fisoc, Inc.), |

| PROVIDENT FINANCIAL SERVICES, INC.| | | ||

The age and business experience of Provident’s executive officers who are not directors are as follows:

Finn M. W. Caspersen, Jr.

Age 50

Mr. Caspersen has been Executive Vice President - Director of Retail Banking Operations of Provident Bank since August 2018. Previously, he held various executive positions at Peapack-Gladstone Bank, including Chief Strategy Officer, Chief Operating Officer, Chief Risk Officer and General Counsel.

James A. Christy

Age 5254

Mr. Christy has been Executive Vice President and Chief Risk Officer of Provident Bank since February 2018, and prior to that time he was Senior Vice President and Chief Risk Officer since January 2012. He previously served as

Robert Capozzoli

Age 51

Mr. Capozzoli has been Senior Vice President & General Auditorand Chief Marketing Officer since January 2009.2019, and prior to that time he was First Vice President and Marketing Director since 2015.

Vito Giannola

Age 45

Mr. Giannola has been Executive Vice President – Chief Retail Banking Officer since August 2020. Prior to that time, he was Senior Executive Vice President and Chief Banking Officer of SB One Bank since March 2018.

Brian Giovinazzi

Age 6567

Mr. Giovinazzi has been Executive Vice President and Chief Credit Officer of Provident Bank since December 2008.

John Kamin

Age 6264

Mr. Kamin has been Executive Vice President and Chief Information Officer of Provident Bank since May 2017, and prior to that time, he was Executive Vice President and Chief Information Officer of Old National Bank located in Evansville, Indiana since 2011.

John Kuntz

Age 6466

Mr. Kuntz has been Senior Executive Vice President, General Counsel and Corporate Secretary of Provident and Senior Executive Vice President and Chief Administrative Officer of Provident Bank since January 2019, and prior to that time, he was Executive Vice President, General Counsel and Corporate Secretary of Provident and Executive Vice President and Chief Administrative Officer of Provident Bank since January 2011.

George Lista

Age 62

Mr. Lista has been President and Chief Executive Officer of SB One Insurance Agency, Inc., a wholly owned subsidiary of Provident Bank, since 2001. Mr. Lista has over 35 years of experience in the insurance industry.

Thomas M. Lyons

Age 5557

Mr. Lyons has been Senior Executive Vice President and Chief Financial Officer of Provident and Provident Bank since January 2019, and prior to that time, he was Executive Vice President and Chief Financial Officer of Provident and Provident Bank since January 2011.

Josephine MoranBennett MacDougall

Age 5650

Ms. MoranMr. MacDougall has been ExecutiveSenior Vice President - Director of Retail Bankingand General Counsel of Provident Bank, General Counsel of Beacon Trust, and Deputy General Counsel of Provident Financial Services, Inc. since August 2018. Prior to that time, she was Senior Vice President - Regional Manager Retirement Services for Webster Bank since 2016. She2021. He previously served as Executive Vice President -Managing Director and Associate General Counsel of Retail for ColumbiaThe Bank of New York Mellon since October 2015, and Executive Vice President - Region President for Santander Bank since 2011.2015.

Valerie O. Murray

Age 4547

Ms. Murray ishas been President of Beacon Trust Company, a wholly owned subsidiary of Provident Bank, since February 2017, and Executive Vice President and Chief Wealth Management Officer of Provident Bank since January 2019. Prior to that time, she was Senior Vice President and Chief Wealth Management Officer of Provident Bank since February 2017. She previously served as Chief Operating Officer of Beacon Trust Company since January 2016, and prior to that time, she served as Executive Managing Director and Vice President of Beacon Trust Company since 2011.2016.

Frank S. Muzio

Age 6668

Mr. Muzio has been Executive Vice President and Chief Accounting Officer of Provident Bank since February 2018, and prior to that time, he served as Senior Vice President and Chief Accounting Officer since 2011.

| www.provident.bank | PROVIDENT FINANCIAL SERVICES, INC. | 2022 Proxy Statement | 12 | ||

Carolyn Powell

Age 5456

Ms. Powell joined Provident Bank ashas been Executive Vice President and Chief Human Resources Officer onsince March 2, 2020. She previously served as Vice President, Human Resources for Conduent, a leading business services and solutions company since 2017. Prior to that time she was a Director of Human Resources with Horizon Blue Cross Blue Shield of New Jersey.

Walter Sierotko

Age 58

Mr. Sierotko has been Executive Vice President – Chief Lending Officer since April 2020, and prior to that time was Executive Vice President – Commercial Real Estate since November 2015. He previously held positions with Wells Fargo, Bank of New York and HSBC.

| PROVIDENT FINANCIAL SERVICES, INC. | | | |||

CorporateEnvironmental, Social and Governance Governance(“ESG”) Matters

Our board of directors and management are committed to maintaining sound corporate governance principles and the highest standards of ethical conduct. The board’s main responsibility is the oversight of the company’s management team, and the board has taken measures to ensure that the board’s composition, organization, and operation are designed to deliver strong performance for the company’s stockholders. We are in compliance with applicable corporate governance laws and regulations. The following

Our company is keenly aware of its responsibilities as a good corporate citizen to all of its stakeholders: its stockholders, customers, employees, and the communities we serve and in which we live and work. Among these responsibilities are some key featuresthe maintenance of ethical business practices in our everyday business dealings, adherence to transparency in our corporate governance practices:protocols, an ongoing focus on diversity and inclusion in our employment practices, and a recognition of the long-term benefits associated with reliance on sustainable resources in the operation of our branch banking offices and support locations. Provident is also cognizant of the challenges posed by the transition to a lower-carbon economy, and the potential impact of climate change on our business and our customers.

| BOARD OVERSIGHT AND ESG COUNCIL |

Our Governance/Nominating Committee leads oversight of the company’s ESG efforts. The Compensation and Human Capital and Risk Committees also play a critical role in overseeing elements of our ESG strategies.

The company formed its ESG Council in 2021. The ESG Council is led by Provident Bank’s General Counsel, and consists of senior representatives from the business as well as control functions. The aim of the ESG Council is to provide guidance to the organization with respect to industry best practices, emerging regulatory and corporate governance developments, and to better inform investors, customers, and stakeholders of the company’s commitment to ESG issues. The ESG Council reports regularly to the Governance/Nominating Committee, the Chief Executive Officer and the executive leadership team, regarding the work of the Council and the progress it has made in building and implementing the ESG program.

| SOCIAL RESPONSIBILITY |

Employee Experience

Attracting Top Talent

Provident has 1,122 full-time and 41 part-time employees. As part of our ongoing efforts to attract qualified, motivated, and diverse employees, Provident has adopted best-in-class practices to see that underrepresented talent is consistently presented to hiring managers. We have expanded our recruitment reach to include additional local colleges, universities and career fairs. We have also enhanced the employee onboarding process through automation and streamlined manager and employee tools. Provident tracks the employee-onboarding life cycle and partners with leaders to attract candidates who will be a good cultural fit for Provident.

| PROVIDENT FINANCIAL SERVICES, INC. | 2022 Proxy Statement | 14 | |||

Talent Review, Development and Succession Planning

Provident leadership engages in development discussions with employees to better clarify career aspirations, shares general feedback (both positive and developmental), and creates development plans to help employees reach their career aspirations and achieve performance goals. Provident works with its leaders to help identify and cultivate employees that exhibit the guiding principles all future Provident leaders should exemplify. We also continually evaluate succession plans to ensure smooth continuity of leadership.

Leadership Development Programs

We recognize that strategic leadership development training provides an opportunity for first–level supervisors up to executive leaders to learn key skills that translate into successful business results. People leaders are offered a combination of instructor-led and web-based training on a variety of topics including but not limited to communication, performance management and talent management for leaders and future leaders.

Internship Programs

Provident offers internship opportunities to students seeking a career in financial services. In 2021, we provided internship opportunities for 24 college students. During the ten week program, students had the opportunity to work in various lines of business across the organization. Interns benefited from training, coaching, and mentoring, and interacting with executive leaders. Also in 2021, a newly formed partnership with INROADS reinforced the Bank’s commitment to diversity and inclusion. The partnership with INROADS offers internship opportunities to college students. INROADS is a leader in advancing underserved youth in corporate America. They offer talented, underrepresented youth a pathway from high school to college and throughout their career that helps to close opportunity and wealth gaps.

Associate Recognition Programs

The R.O.C. (“Recognizing Outstanding Commitment”) Awards Program is the company’s internal award program created to acknowledge and reward employees for exhibiting behaviors that support the mission, goals, values, initiatives, and Guiding Principles of our organization when interacting with internal and external customers. We recognize and reward several amazing employees every month who consistently go above and beyond in their day-to-day contribution to our organization.

Volunteer Programs

“Commit to Care” is an employee engagement program that provides employees of the company with opportunities to contribute their unique talents, skills, and knowledge toward improving their communities. Through education, volunteerism, and meaningful engagement, participants aspire to bring about positive change. The company provides paid time off for volunteering that takes place during business hours. As part of the company’s benefits package, employees may donate up to 15 hours per year toward a charitable, civic, or school organization.

Employee Well Being and Benefits

Engagement Survey

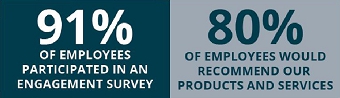

Our Executive Leadership Team is committed to addressing the opportunities identified by annual employee engagement surveys and improving the employee experience as valued members of our organization. In 2021, 91% of our employees participated in the Engagement Survey. Moreover, more than 80% of our employees would recommend our products and services to friends and family. Provident is committed to continuing to foster a team-oriented, diverse culture; providing career opportunities and professional development; enhancing the customer experience through tools and education; and communicating our mission, vision and strategic plan for the organization.

Work-Life Integration Programs

Rather than drawing a line between work-life and personal life, we strive to provide employees with viable options that include volunteer time, paid vacation time and leave entitlements. Employees can also work with their managers to engage in several alternative work schedules based on the functions they perform. Options include some remote work, flextime, and employee self-directed movement to focus on personal matters. As a company with strong ties to the community, we wholly support employees taking time to give back and encourage a healthy balance of vacation utilization so employees can take care of themselves, their families and create meaningful contributions when they are at work.

Financial Well-Being

We believe that an employee’s financial circumstance should not be an impediment to her or his access to education. Our Tuition Education Assistance Program provides for advance disbursement of up to $250 per credit up to 12 credits (maximum $3,000 per year) for undergraduate courses leading to an associate or bachelor’s degree. The program offers reimbursement of up to $500 per credit up to 12 credits

| PROVIDENT FINANCIAL SERVICES, INC. | 2022 Proxy Statement | 15 | ||

(maximum $5,000 per year) for graduate courses leading to an MBA or Master’s related degree.

Additionally, after three months of employment, employees can benefit from our Student Loan Paydown Program to assist with outstanding education debt. This program offers eligible employees the option to receive $100 per month, for up to 60 months (maximum $6,000) in the repayment of student loans. Employees may also be eligible to receive continuing education assistance and, for certain functions, the option to increase their base salary after the completion of professional certification programs.

Employees also share in our financial success while preparing for retirement through the Employee Stock Ownership Plan, or ESOP. The ESOP gives employees an opportunity to accumulate shares of our common stock and is 100% funded by the company. To further assist our employees with retirement planning, our 401(k) plan has a 25% company match on the first 6% of eligible compensation deferred.

Physical and Emotional Well-Being

In order to protect our employees and customers throughout the COVID-19 pandemic, we instituted state-of-the-art pandemic protocols throughout our branches and corporate offices. Protocols included remote working and social distancing measures.

Provident Women

The Provident Women program was established in 2014 and is committed to providing the resources to allow all women in the company the opportunity to grow personally and professionally through education, networking events and volunteer opportunities in an environment of inclusion and acceptance. ProvidentWomen sponsored a combination of eleven programs/events in 2021.

Diversity, Equity and Inclusion

We recognize the importance of maintaining a socially and culturally diverse employee base. Diversity in the workplace provides a unique opportunity to obtain a variety of perspectives, experiences and resources that better reflect the customers and communities we serve. It is the company’s expectation that our continued actions and behaviors result in a working environment which encourages and respects diversity and provides an equal opportunity for employment, development and advancement. We base employment decisions on merit, considering qualifications, skills and achievements. We treat our co-workers fairly and with respect.

Our company is committed to fostering a safe working environment, which promotes diversity and is free from harassment or discrimination of any kind. We are proud of our diverse workforce, including women holding 63% of all managerial positions. In 2021, the company hired its first Senior Human Resources and Diversity Business Partner as part of its ongoing commitment to advance diversity, equity, and inclusion (“DEI”) initiatives.

Some of our DEI initiatives and proposed initiatives include: partnering with organizations that will help to expand diverse talent pools and create an internal pipeline; enhancing career development through training and mentorship; and expanding inclusion efforts through resource groups, and diversity and inclusion training.

Community Engagement, Investment and Philanthropy

Small Business Loans

The company embraced its role as a community leader with its response to the COVID-19 pandemic. We mobilized quickly to enable our small business customers to access the CARES Act Paycheck Protection Program (“PPP”).

Since the inception of the program, the company processed over 1,300 applications for PPP loans totaling more than $470 million.

| www.provident.bank | PROVIDENT FINANCIAL SERVICES, INC. | 2022 Proxy Statement | 16 | ||

Philanthropy: The Provident Bank Foundation (the “Foundation”)

The Foundation was established in January 2003 with an initial funding of $24.7 million. The Foundation is dedicated to supporting not-for-profit groups, institutions, schools and other 501(c)(3) organizations that provide valuable services to the communities served by the company. The Foundation is committed to strengthening and sustaining its relationship with communities in our marketplace.

As of December 31, 2021, the Foundation had $23.8 million in total assets and for all of 2021 funded 148 grants for a total of $1.2 million. In 2020, despite the impact of the pandemic, the Foundation awarded 109 grants for a total of $949,540, which included $125,000 in COVID-19 Emergency Response Grants of $5,000 each to 25 nonprofit organizations whose communities are served by Provident through three Funding Priority Areas: Community Enrichment, Education, and Health, Youth & Families.

Financial Literacy Efforts

EverFi

The company partnered with global education technology leader EverFi during the pandemic to provide financial literacy programs to high schools within the communities we serve. Through the partnership, we were able to offer free access to over 20 digital courses in a wide variety of subjects to students in grades K through 12.

Financial Wellness Center

The company provides this online resource to provide visitors with an engaging learning experience relating to critical personal financial topics, such as building emergency savings, mortgage education and retirement planning.

Supporting Affordable Housing

The Community Reinvestment Act (“CRA”) encourages depository institutions to help meet the credit needs of the communities in which they operate, including low-and moderate-income neighborhoods, consistent with safe and sound banking operations.

Among its recent CRA activities, in 2021 the company awarded $475,000 in funding to five non-profit organizations as part of the New Jersey Department of Community Affairs, Neighborhood Revitalization Tax Credit Program. The nonprofit organizations used the funding to implement revitalization plans addressing housing and economic development, providing opportunities for entrepreneurs to start businesses and job training for local residents, as well as complementary activities such as social services, recreation activities, and open space improvements.

| PROVIDENT FINANCIAL SERVICES, INC. | 2022 Proxy Statement | 17 | ||

| BOARD COMPOSITION |

| (1) | Mr. Fekete has served on the board of directors |

| www.provident.bank | PROVIDENT FINANCIAL SERVICES, INC. | 2022 Proxy Statement | 18 | ||

Board

| BOARD SKILLS |

The following matrix provides information regarding members of Directors Meetings and Committees

Ourour board of directors, meets quarterly,including certain types of knowledge, skills, experiences and attributes possessed by one or more often as mayof them which our board has determined to be necessary.relevant to our business and structure. The board of directors met nine times in 2019. There are five standing committeesmatrix does not encompass all of the knowledge, skills, experiences or attributes of our directors, and the fact that a particular skill is not listed does not mean that a director does not possess the skill. In addition, the lack of a particular knowledge, skill, experience or attribute with respect to any of our directors does not mean the director is unable to contribute to the decision-making process in that area. The degree and type of knowledge, skills, and experience listed below may vary among the board of directors: the Audit, Compensation, Risk, Technology and Governance/Nominating Committees. The board of directors of Provident Bank meets monthly at least 11 times a year, as required by New Jersey banking law.members.

All directors attended no fewer than 75% of the total number of meetings held by the board of directors and all committees of the board on which they served (during the period they served) in 2019. When the Provident and Provident Bank board of directors and committee meetings are aggregated, all directors attended no fewer than 75% of the aggregated total number of meetings in 2019. We have a policy requiring each director to attend the Annual Meeting of Stockholders. All persons serving on the board of directors at the time of the Annual Meeting of Stockholders held on April 25, 2019 attended the meeting, with the exception of Carlos Hernandez who was unable to attend due to a family emergency.

| Skill | # of Directors | |||

| Audit/Financial | Experience in finance, accounting and/or auditing |  | ||

| Commercial/Real Estate Knowledge | Knowledge of real estate markets and financing |  | ||

| Environmental, Social & Governance | Experience with ESG practices |  | ||

| Executive Experience | Experience managing a sophisticated organization |  | ||

| Industry Knowledge | Experience in banking, investment management and/or insurance |  | ||

| Risk | Experience in management of business risk at a complex organization |  | ||

| Technology/Cyber | Knowledge of cybersecurity, innovative technology and information technology |  |

| PROVIDENT FINANCIAL SERVICES, INC. | 2022 Proxy Statement | 19 | ||

Our board of directors believes that combining thehaving an Executive Chairman, and Chief Executive Officer positions, together with the appointment of an independent Lead Director, is the appropriate board leadership structure for our company. Carlos Hernandez currently serves as the Lead Director. Christopher Martin serves as Executive Chairman. Our board of directors has determined that the Chief Executive OfficerChairman is most knowledgeable about our business and corporate strategy, and is in the best position to lead the board of directors, especially in relation to its oversight of corporate strategy formation and execution. Management accountability and our board’s independence from management are best served by maintaining a super majority of independent directors, electing an independent Lead Director, and maintaining standing board committees that are comprised of independent leadership and members. The Lead Director plays an important role on our board of directors and has the following responsibilities:

Our board of directors meets quarterly, or more often as may be necessary. The board of directors met ten times in 2021. There are five standing committees of the board of directors: the Audit, Compensation and Human Capital, Governance/ Nominating, Risk and Technology Committees. The board of directors of Provident Bank meets monthly at least 11 times a year, as required by New Jersey banking law.

All directors attended at least 93% of the total number of meetings held by the board of directors and all committees of the board on which they served (during the period they served) in 2021. When the Provident and Provident Bank board of directors and committee meetings are aggregated, all directors attended at least 95% of the aggregated total number of meetings in 2021. We have a policy requiring each director to attend the Annual Meeting of Stockholders. All persons serving on the board of directors at the time of the Annual Meeting of Stockholders held on April 29, 2021 participated in the meeting which was a virtual only meeting.

The five standing committees are described in greater detail below, including the names of the directors currently serving on the committees and the committee chairs, a summary of each committee’s duties and responsibilities and notes regarding the number of meetings held in 2021.

The following are some additional key features of our corporate governance practices:

| www.provident.bank | PROVIDENT FINANCIAL SERVICES, INC. | | | ||

Risk Oversight/Risk Committee

AUDIT COMMITTEE

| Composition | Duties and Responsibilities | 2021 Meetings and Charters |

Committee Chair: Mr. Fekete Other Committee Members: Messrs. Adamo, Dunigan, Leppert, and Ms. Leslie. Each member of the Audit Committee is considered independent as defined in the New York Stock Exchange corporate governance listing standards and under SEC Rule 10A-3. The board of directors believes that Messrs. Adamo, Fekete, and Leppert each qualify as an Audit Committee financial expert as that term is defined in the rules and regulations of the Securities and Exchange Commission (“SEC”). | The duties and responsibilities of the Audit Committee include, among other things: • sole authority for retaining, overseeing and evaluating a firm of independent registered public accountants to audit Provident’s annual financial statements; • in consultation with the independent registered public accounting firm and the internal auditor, reviewing the integrity of Provident’s financial reporting processes, both internal and external; • reviewing the financial statements and the audit report with management and the independent registered public accounting firm; • reviewing earnings and financial releases and quarterly and annual reports filed with the SEC; and • approving all engagements for services by the independent registered public accounting firm. | Our Audit Committee met twelve times during 2021. The Audit Committee reports to our board of directors after each meeting on its activities and findings. The Audit Committee’s charter is posted on the “Governance Documents” section of the “Investor Relations” page of Provident Bank’s website at www.provident.bank. |

Our entire board of directors is engaged in risk management oversight. A separate standing Risk Committee of the board facilitates our board’s risk oversight responsibilities. The current members of the Risk Committee are: Ms. Brooks (Chair) and Messrs. Adamo, Berry and Dunigan. Each member of the Risk Committee is considered independent as defined in the New York Stock Exchange corporate governance listing standards. The Risk Committee’s charter is posted on the “Governance Documents” section of the “Investor Relations” page of Provident Bank’s website at www.provident.bank. The Committee met seven times during 2019.

COMPENSATION AND HUMAN CAPITAL COMMITTEE

The Risk Committee oversees the overall risk management activities employed by management in pursuit of:

| Composition | Duties and Responsibilities | 2021 Meetings and Charters |

Committee Chair: Mr. Harding Other Committee Members: Messrs. Dunigan, Gallagher, Leppert, and Pugliese. Each member of the Compensation and Human Capital Committee (“Compensation Committee”) has been determined to be independent as defined in the New York Stock Exchange corporate governance listing standards. | The Compensation Committee is responsible for, among other things: • reviewing the performance of, and the compensation payable to, our named executive officers, including the President and Chief Executive Officer; • the compensation payable to our non-management directors; • management development and succession planning; • human capital management oversight, including diversity and inclusion and pay equity; • reviewing and evaluating incentive compensation plans and risks associated with such plans; and • engaging the compensation consultant, Frederic W. Cook & Co., Inc. (“FW Cook”). The Compensation Committee’s oversight of our incentive compensation plans includes setting corporate performance measures and goals consistent with principles of safety and soundness, approving awards and administering long- term equity awards. Director compensation is established by our board of directors upon the recommendation of the Compensation Committee and is discussed in this Proxy Statement under the heading “Director Compensation.” | The Compensation Committee met six times during 2021. The Compensation Committee’s charter is posted on the “Governance Documents” section of the “Investor Relations” page of Provident Bank’s website at www.provident.bank. |

| PROVIDENT FINANCIAL SERVICES, INC. | 2022 Proxy Statement | 21 | ||

GOVERNANCE/NOMINATING COMMITTEE

| Composition | Duties and Responsibilities | 2021 Meetings and Charters |

Committee Chair: Mr. Hernandez Other Committee Members: Messrs. Berry, Fekete, Gallagher and Pugliese. Each member of the Governance/ Nominating Committee is considered independent as defined in the New York Stock Exchange corporate governance listing standards. | The functions of our Governance/ Nominating Committee include, among other things: • evaluating and making recommendations to the board concerning the number of directors and committee assignments; • establishing the qualifications, skills, relevant background, diversity and other selection criteria for board members; • making recommendations to the board concerning board nominees; • conducting evaluations of the effectiveness of the operation of the board and its committees; • developing and maintaining corporate governance principles; • recommending revisions to the code of business conduct and ethics; • oversight of ESG Council progress and activities; • making recommendations to the board regarding director orientation and continuing education; and • making recommendations to the board regarding director orientation and continuing education. | The Governance/Nominating Committee met seven times during 2021. The Governance/Nominating Committee’s charter is posted on the “Governance Documents” section of the “Investor Relations” page of Provident Bank’s website at www.provident.bank. |

RISK COMMITTEE

| Composition | Duties and Responsibilities | 2021 Meetings and Charters |

Committee Chair: Mr. Dunigan Other Committee Members: Messrs. Adamo, Berry, McNerney and Ms. Foley. Each member of the Risk Committee is considered independent as defined in the New York Stock Exchange corporate governance listing standards. | Our entire board of directors is engaged in risk management oversight. The separate standing Risk Committee facilitates our board’s risk oversight responsibilities. The Risk Committee oversees the overall risk management activities employed by management in pursuit of: •maintaining an effective culture of discipline that provides proper guidance and support for a sound, effective and coordinated enterprise risk management process designed to identify potential events that may affect our business and to appropriately manage risks in order to provide reasonable assurance that our stated objectives will be achieved; and | |

• | identifying potential emerging risks in a routine and systematic manner, assessing the implications of those risks to our business, and managing those risks in a manner consistent with reducing the probability of their occurrence and potential consequences to our company to an acceptable level. |

Our Risk Committee receives regular reports from management, including the Chief Risk Officer and Chief Information Security Officer, and other standing board committees regarding interest rate, liquidity, credit, operational, compliance, technology, data security, third party and cyber risks, as well as other relevant risks and the actions taken by management to adequately address and mitigate those risks.

Corporate Governance Principles

Our board of directors has adopted Corporate Governance Principles which are posted on the “Governance Documents” section of the “Investor Relations” page of Provident Bank’s website at www.provident.bank. These Corporate Governance Principles cover the general operating policies and procedures followed by our board of directors including:

The Risk Committee met seven times | |

The Corporate Governance Principles provide for our board of directors to meet in regularly scheduled executive sessions without management at least two times a year. Five executive sessions were conducted in 2019. The Lead Director presided over these executive sessions conducted by the non-management directors, all of whom are independent.

Director Independence

The New York Stock Exchange rules provide that a director does not qualify as independent unless the board of directors affirmatively determines that the director has no direct or indirect material relationship with the company. The New York Stock Exchange rules require our board of directors to consider all relevant facts and circumstances in determining the materiality of a director’s relationship with Provident and permit the board of directors to adopt and disclose standards to assist the board in making independence determinations. Accordingly, our board of directors has adopted Independence Standards to assist the board in determining whether a director has a material relationship with the company. These Independence Standards, which should be read with the New York Stock Exchange rules, are availableduring 2021.

The Risk Committee’s charter is posted on the “Governance Documents” section of the “Investor Relations” page of Provident Bank’s website at www.provident.bank.

Our board of directors conducted an evaluation of director independence, based on the Independence Standards and the New York Stock Exchange rules. In connection with this review, our board of directors considered relevant facts and circumstances relating to relationships that each director and his or her immediate family members and their related interests had with Provident. In connection with its evaluation of director independence, the board considered the following relationships and transactions:

| www.provident.bank | PROVIDENT FINANCIAL SERVICES, INC. | | | ||

After its evaluation, our board of directors affirmatively determined that Messrs. Adamo, Berry, Dunigan, Fekete, Gallagher, Harding, Hernandez, and Pugliese and Ms. Brooks and Ms. Foley are each an independent director. The board of directors determined that Mr. Martin is not independent because he serves as President and Chief Executive Officer of Provident.TECHNOLOGY COMMITTEE

Governance/Nominating Committee

The current members of our Governance/Nominating Committee are: Messrs. Hernandez (Chair), Berry, Fekete, and Gallagher. Each member of the Committee is considered independent as defined in the New York Stock Exchange corporate governance listing standards. The Committee’s charter is posted on the “Governance Documents” section of the “Investor Relations” page of Provident Bank’s website at www.provident.bank. The Committee met six times during 2019.

The functions of our Governance/Nominating Committee include, among other things:

| 2021 Meetings and Charters | ||

Committee Chair: Mr. Pugliese Other Committee Members: Ms. Foley and Messrs. Gallagher and Harding. Each member of the Technology Committee is considered independent as defined in the New York Stock Exchange corporate governance listing standards. | The Technology Committee assists the board | |

| significant investments, and technology-related risks, including cyber and data security risks. • Review the major technology risk exposure, including operational aspects of information security and cybersecurity risks, and the steps taken to monitor and control such exposures; • Review the Company’s risk management and risk assessment guidelines and policies regarding technology risk; and • Receive reports from management regarding the Company’s business continuity planning. | The Technology Committee met four times during 2021. Our Technology Committee operates under a written charter approved by our board of directors, which is posted on the | |

BOARD NOMINEE EVALUATION AND SELECTION PROCESS

Our Governance/Nominating Committee identifies nominees for director by first assessing the performance, qualifications and skills of the current members of our board of directors willing to continue service. Current members of the board with skills and experience that are relevant to our business and who are willing to continue service are first considered for re-nomination, balancing the value of continuity of service by existing members of the board with that of obtaining a new perspective.

In the case of a current member of the board of directors, prior to re-nomination an evaluation of the board member’s performance is conducted by the Governance/Nominating Committee using a written self-evaluation submitted by the current member, andas well as input from each other director obtainedbased on interviews conducted by the Lead Director. The Lead Director provides feedback to each current member being considered for re-nomination based on the input received from other directors.

If a vacancy should exist on our board, or if the size of the board is increased, the Governance/Nominating Committee will solicit suggestions for director candidates from all board members. In addition, the Governance/Nominating Committee is authorized by its charter to engage a third party to assist in the identification of director nominees. Persons under consideration to serve on our board of directors must have the highest personal and professional ethics and integrity.

Annual Board and Committee Performance Evaluations

ANNUAL BOARD AND COMMITTEE PERFORMANCE EVALUATIONS

Each year the board of directors conducts an evaluation of the board’s performance that seeks feedback from directors on the functioning of the board, including the board’s committee structure and leadership, culture, process, skills and resources. Typically, this evaluation is conducted using written questionnaires and the responses are reviewed with the Governance/Nominating Committee and at an executive session of the full boardnon-executive directors conducted by the Lead Director. TheIn the past the board of directors has utilized, and annually considers the use of a third party to assist it in the annual performance evaluation.

Each committee of the board of directors conducts an annual written assessment of its performance which is reviewed by the committee and reported to the Governance/Nominating Committee.

| PROVIDENT FINANCIAL SERVICES, INC. | | | ||

Procedures for the Recommendation of Directors by Stockholders

PROCEDURES FOR THE RECOMMENDATION OF DIRECTORS BY STOCKHOLDERS

If a determination is made that an additional candidate is needed for our board, the Governance/Nominating Committee will consider candidates properly submitted by our stockholders. Stockholders can submit the names of qualified candidates for director by writing to the Corporate Secretary at Provident Financial Services, Inc., 100111 Wood Avenue South, P.O. Box 1001, Iselin, New Jersey 08830-1001. The Corporate Secretary must receive a submission not less than 120 days prior to the date of Provident’s proxy materials for the preceding year’s Annual Meeting. A stockholder’s submission must be in writing and include the following information:

| • | the name and address of the stockholder as they appear on our books, and the number of shares of our common stock that are beneficially owned by such stockholder (if the stockholder is not a holder of record, appropriate evidence of the stockholder’s ownership should be provided); |

| • | the name, address and contact information for the candidate, and the number of shares of our common stock that are owned by the candidate (if the candidate is not a holder of record, appropriate evidence of the candidate’s ownership should be provided); |

| • | a statement of the candidate’s business and educational experience; |

| • | such other information regarding the candidate as would be required to be included in our proxy statement pursuant to SEC Regulation 14A; |

| • | a statement detailing any relationship between the candidate and Provident, Provident Bank and any subsidiaries of Provident Bank; |

| • | a statement detailing any relationship between the candidate and any customer, supplier or competitor of Provident and Provident Bank; |

| • | detailed information about any relationship or understanding between the proposing stockholder and the candidate; and |

| • | a statement that the candidate is willing to be considered and willing to serve as a director if nominated and elected. |

Stockholder submissions that are timely and that meet the criteria outlined above will be forwarded to the Chair of our Governance/Nominating Committee for further review and consideration. A nomination submitted by a stockholder for presentation at an Annual Meeting of our stockholders must comply with the procedural and informational requirements described later in this Proxy Statement under the heading “Advance Notice Of Business To Be Conducted at an Annual Meeting.”

Majority Voting Policy

MAJORITY VOTING POLICY

Our board of directors believes that each director should have the confidence and support of our stockholders. To that end, we have a majority voting policy that applies in uncontested elections of directors at a stockholders’ meeting. The policy is not applicable in any contested director election. Under our majority voting policy, any incumbent director nominee in an uncontested election who receives a greater number of votes “WITHHELD” than votes cast “FOR” at a meeting of stockholders shall promptly tender his or her proposed resignation following the certification of the stockholder vote.

The Governance/Nominating Committee will consider the resignation and will recommend to the board whether to accept the resignation or take other action, including rejecting the resignation and addressing any apparent underlying causes of the failure of the director to obtain a majority of votes “FOR” his or her election. The board will act on the Governance/Nominating Committee’s recommendation no later than 90 days following the certification of the stockholder vote. The company will publicly disclose the board’s decision and process in a periodic or current report filed with or furnished to the SEC within 90 days following the certification of the stockholder vote. Any director who tenders his or her resignation will not participate in the Governance/Nominating Committee’s or full board’s deliberations, considerations or actions regarding whether or not to accept or reject the resignation or take any related action.

| www.provident.bank | PROVIDENT FINANCIAL SERVICES, INC. | 2022 Proxy Statement | 24 | ||

Stockholder and Interested Party Communications with the Board

STOCKHOLDER AND INTERESTED PARTY COMMUNICATIONS WITH THE BOARD

Our stockholders and any other interested party may communicate with the board of directors, the non-managementnonmanagement directors, the Lead Director or with any individual director by writing to the Chair of the Governance/Nominating Committee, c/o Provident Financial Services, Inc., 100111 Wood Avenue South, P.O. Box 1001, Iselin, New Jersey 08830-1001. A communication from a stockholder should indicate that the author is a stockholder and, if shares of our common stock are not held of record, the letter should include appropriate evidence of stock ownership.

Code of Business Conduct and Ethics

CODE OF BUSINESS CONDUCT AND ETHICS

We have a Code of Business Conduct and Ethics that applies to all of our directors, officers and employees, including the principal executive officer, principal financial officer, principal accounting officer, and all persons performing similar functions. Compliance with our Code is essential and promotion of its principles of honesty, integrity and fair dealing, as well as compliance with laws and regulations, is the responsibility of each and every one of our directors, officers and employees. Our Code of Business Conduct and Ethics is posted on the “Governance Documents” section of the “Investor Relations” page of Provident Bank’s website at www.provident.bank. Amendments to and waivers from our Code of Business Conduct and Ethics will also be disclosed on Provident Bank’s website.

Transactions With Certain Related PersonsEthical Business Practices